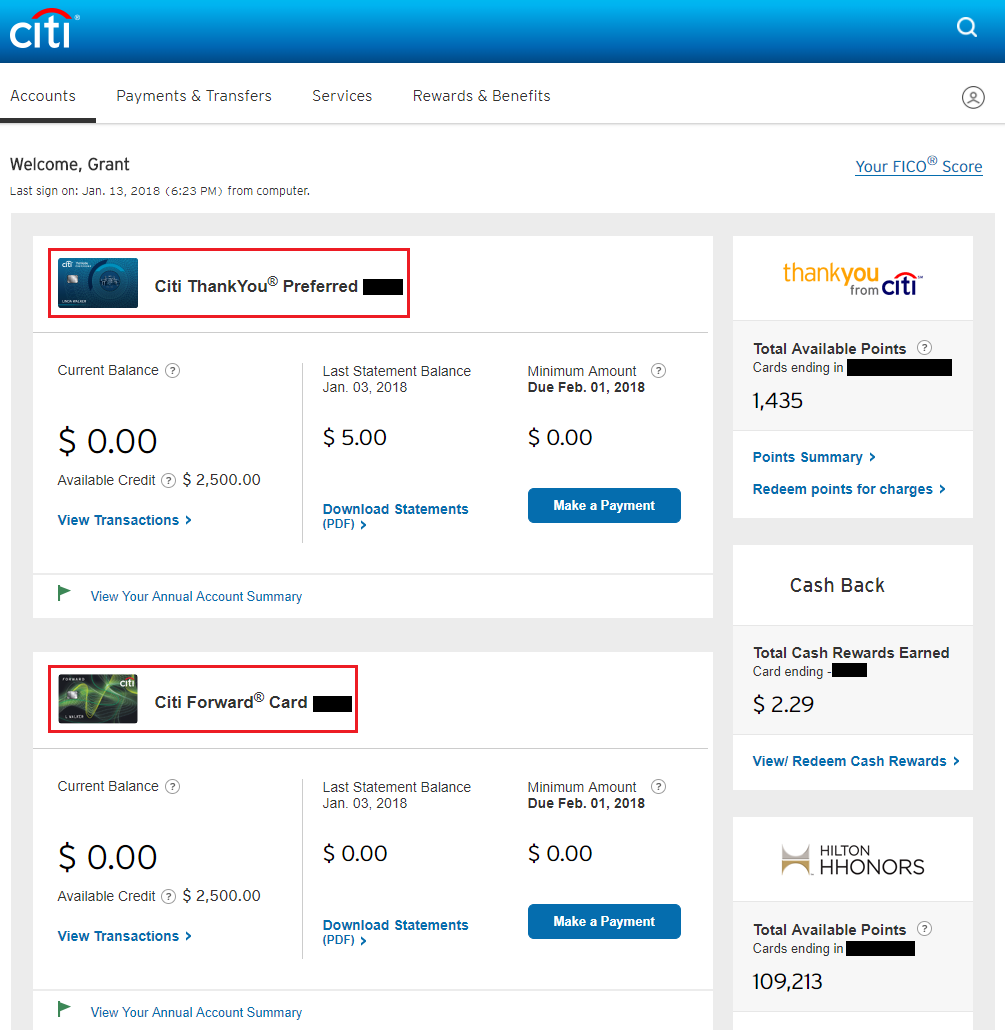

If you are searching getting getting dollars to own costs, home renovations or any other expenditures, your house guarantee you certainly will bring a simple solution. Discover multiple treatment for tap into your equity, even if. Our company is extracting advantages and downsides of property collateral loan vs. a HELOC versus. refinancing that have cash-out.

Home values inside the Arizona has actually stayed high and you will interest levels possess hovered close historic downs in recent times, leading to of a lot residents to take on borrowing from the bank against their home’s equity. What exactly is guarantee? The difference between the value of your residence plus the number you continue to owe on your own home loan.

Eg, whether your home is currently valued at $350,100000 considering a home appraisal along with a beneficial $175,100000 balance kept in your mortgage, might possess up to $175,000 in equity. You happen to be able to borrow secured on the security for those who you would like loans getting fixes, remodeling, costs or other expenses. If you are loan providers wouldn’t generally financing you the full-value of residence’s security, they might financing doing 80% of it on average.

- Which have a house collateral loan

- That have good HELOC (Home Security Personal line of credit)

- From the refinancing the financial which have an earnings-out alternative

Family Guarantee Financing: The new Steady Alternatives

A home guarantee mortgage spends the collateral of your house since security. Generally, the lender commonly arrange for property assessment to worth their house. Which have a home guarantee mortgage, you would use a-flat count on a fixed rate of interest and you can pay it off when you look at the equivalent monthly obligations like you will do that have a car loan.

- Your own interest doesn’t fluctuate, due to the fixed rates

- You understand how much cash you can easily pay each month

- An upfront fee for your requirements of one’s entire loan amount

HELOC: Self-reliance & Solutions

A beneficial HELOC, otherwise home paydayloanalabama.com/dunnavant equity personal line of credit, as well as borrows resistant to the equity you may have of your house. HELOCs normally have varying prices, which means your rate of interest usually change down and up that have the marketplace.

- After being approved to possess a great HELOC, this new approved amount acts like your borrowing limit toward a cards card.

- You could potentially withdraw some or all HELOC funds as you need him or her.

- Distributions, labeled as developments, can be removed via your draw months (generally, 5 to 10 years).

Example: Let’s say your recognized having good $35,100 HELOC. You withdraw $5,100 from your HELOC to spend specific immediate debts. Five months afterwards, you withdraw $ten,one hundred thousand to pay for your bathrooms upgrade. Thus far, you may have used all in all, $15,one hundred thousand of your HELOC money, making $20,100000 still offered.

The payment per month into a great HELOC is dependent on your full a great harmony, whether or not the amount utilized are taken as the a-one lump sum or since the several advancements.

Certain lenders, for example Wasteland Economic, supply a crossbreed HELOC to your option of a predetermined speed with the specific distributions. These types of loan enables you the flexibility out-of a vintage HELOC if you’re nonetheless providing the comfort regarding a flat interest.

Such loan is effective having times when you may need the cash in faster increments through the years – such as for instance, if you are planning to do numerous remodeling ideas from the coming age or you enjoys several goals we should visited (like consolidating higher-focus financial obligation repayments and you may investing in domestic solutions).

Refinancing: You to definitely Loan having That which you

The third option for making use of your residence guarantee is refinancing your financial with a money-away option. Inside circumstance, you are substitution your current mortgage with a new domestic loan to possess a much bigger amount than what your already are obligated to pay within the order to gain access to money from the offered guarantee.

Let us come back to the $350,100 family really worth example, where your existing home loan harmony was $175,000. Your work with your bank to find $50,100 cash-out which have home financing re-finance. Very, your brand new home loan matter could well be $225,000 – your current $175,000 harmony as well as the more $fifty,100 cash you are credit regarding the equity of your house.

Your brand-new mortgage possess a predetermined otherwise varying interest with regards to the kind of financing. The newest upside out of a predetermined rate would be the fact the fee count could be the exact same monthly, therefore it is an easy task to policy for. Yet not, in the event that interest rates go lower, you wouldn’t automatically get the all the way down speed. Having a changeable price, you can easily make use of reduced things throughout the market; although not, might supply their rate increase which have develops from the market.

Just how For each and every Loan Rises

Now you see the rules of any financing types of, let’s view exactly how a property security loan, HELOC and money-aside refi pile up with respect to costs and you will masters. Just remember that , not every lender even offers every around three loan sizes, and each financial gets more words and you may available options to possess tapping into your own residence’s equity. Speak to your borrowing from the bank commitment otherwise lending company to possess basic facts towards home collateral alternatives.

Taking it Home

Sooner or later, regarding being able to access this new offered security in your home discover benefits and drawbacks to every financing choice. A basic fixed-rates family collateral mortgage might be good for a single-date you would like when you find yourself cost try lowest, while a money-away refinance works best when you need to stay glued to a great single loan percentage. A home security personal line of credit with a fixed-price option regarding Wasteland Financial offers each other independence and you can comfort of attention, especially if positives such as for instance a minimal basic speed plus the element in order to borrow funds since you need they are important to you personally. Contact me to speak about the options to possess house equity and you will refinancing a mortgage!

The materials presented here is to possess informative intentions just, and that is not intended to be put once the monetary, financing, or legal advice.

Commentaires récents