Trick Takeaways

- A HELOAN is actually a single lump sum loan paid back more than date

- An effective HELOC performs instance credit cards the place you merely fees what you need

- There are 2 methods to accessibility your own equity, by firmly taking away a house security mortgage (HEL), otherwise owing to a house security line of credit (HELOC) .

- One benefit of good HELOC is the fact that initial rate of interest is less than that a home security financing.

- Not absolutely all fund are built equivalent. It is preferable to ask the bank questions and also to contrast loan conditions.

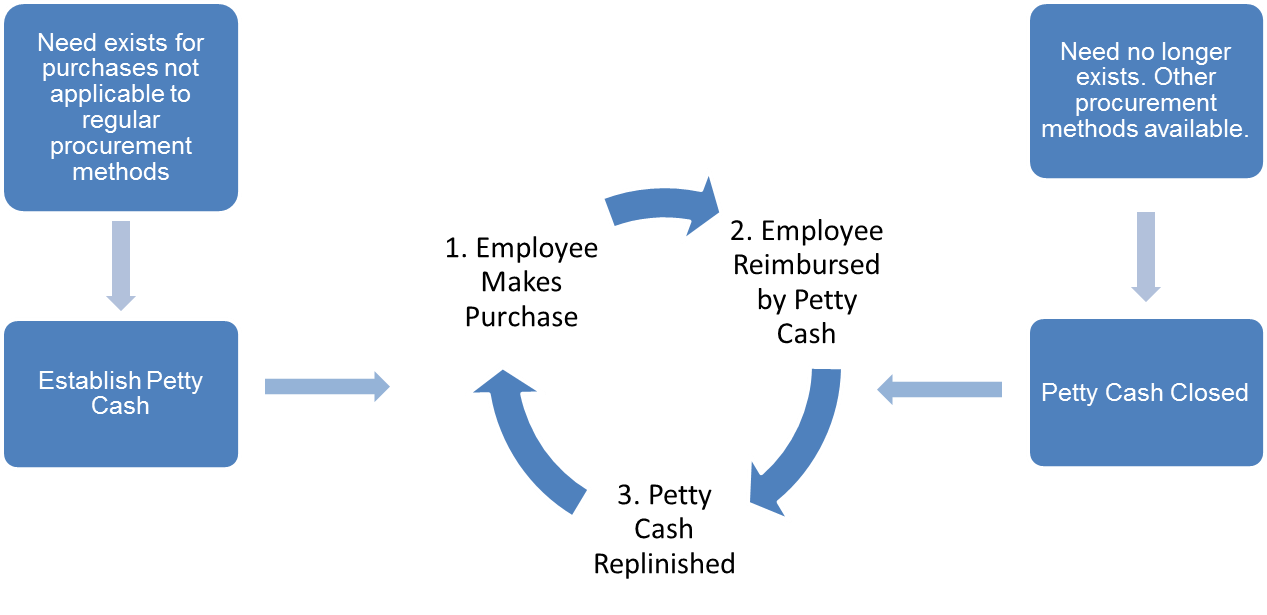

A home Equity Financing (HELOAN) shall be an appartment on the of money that you sign up for at the one point over the years & you’re spend concept and you may interest on that money. You’re not going to have access to the money over and over again like you can which have a house Security Distinctive line of Credit (HELOC). A credit line is also planning to save you money while the most people don’t know exactly how much they you need and how far they wish to need. With a great HELOC you could potentially take-out exactly what you desire a small at a time & pay just appeal thereon matter. That will help save you a fortune about much time run. You’ll have around a decade to access that line out-of borrowing from the bank more than once. Thus giving you the felxibility in order to without difficulty supply funding when new economic means happen.

Comparing the two Sorts of Security Financing

Whether you’re delivering a member of family to college, you want to earn some renovations or consolidate loans, or an unexpected expenses has come up, you can access your own house’s equity by taking away the next home loan. Probably the value of your home has grown, you’ve been and work out repayments in your home loan for a while, otherwise a mixture of both – in either case, you’ve oriented worthwhile guarantee of your house.

There are two main solutions to supply your security, by taking out a house guarantee mortgage (HEL), otherwise because of a home collateral personal line of credit (HELOC). Speaking of known as second mortgage loans and are generally not to ever getting confused with a funds-aside refinance mortgage. The difference may sound slight, but when you may be advised and you will compare household guarantee lending options, you can choose which mortgage is the correct one for your condition.

Influence their guarantee of the subtracting the bill you borrowed on your own mortgage in the reasonable market price in your home and you may assets. Loan providers uses financing-to-really worth ratio (LVR), the total amount you currently owe on your home plus https://availableloan.net/installment-loans-mn/kingston/ the number we would like to use, as compared to its really worth, to decide whether or not they will offer your an additional home loan.

Please be aware that just such as your first mortgage, youre putting your property up just like the guarantee to have another financial. The main benefit of the second financial, in comparison with other kinds of funds, ‘s the relatively lower interest.

What sort of family security loan is perfect for your?

The original question you really need to wonder before deciding brand new between the 2nd home loan solutions are, Carry out I want a lump sum payment right now to pay off a major costs, otherwise do i need to availableness cash sometimes? The second question for you is, Manage We want to shell out that it loan out of easily, or manage We intend to create costs for an excessive period?

What is a house Security Personal line of credit (HELOC)?

A good HELOC are a line of credit, similar to everything discovered away from a charge card organization. You borrow the quantity you prefer as it’s needed, and you spend interest simply into matter your acquire. Generally speaking, HELOC finance keeps a variable interest which is at the mercy of raise or decrease. These types of costs was associated with the new show off a specific list, in addition to good margin, which is detailed in your HELOC financing data. This is why your own month-to-month lowest financing payment you are going to increase otherwise fall off over the years.

Commentaires récents