A beneficial USDA mortgage try a government-recognized, no-money-off mortgage specifically made to have people and you will land from inside the reduced-thicker parts of the country, together with outlying and you will suburban section within the Fl.

If you’re considering to buy a home outside cities, the brand new USDA’s home loan program could offer your several benefits, and down rates and you can payments as compared to almost every other authorities-recognized programs including FHA and you will Virtual assistant.

Inside Fl, the USDA is short for the us Institution away from Agriculture, a company known for the engagement from inside the agriculture, forestry, and you may eating-associated attempts.

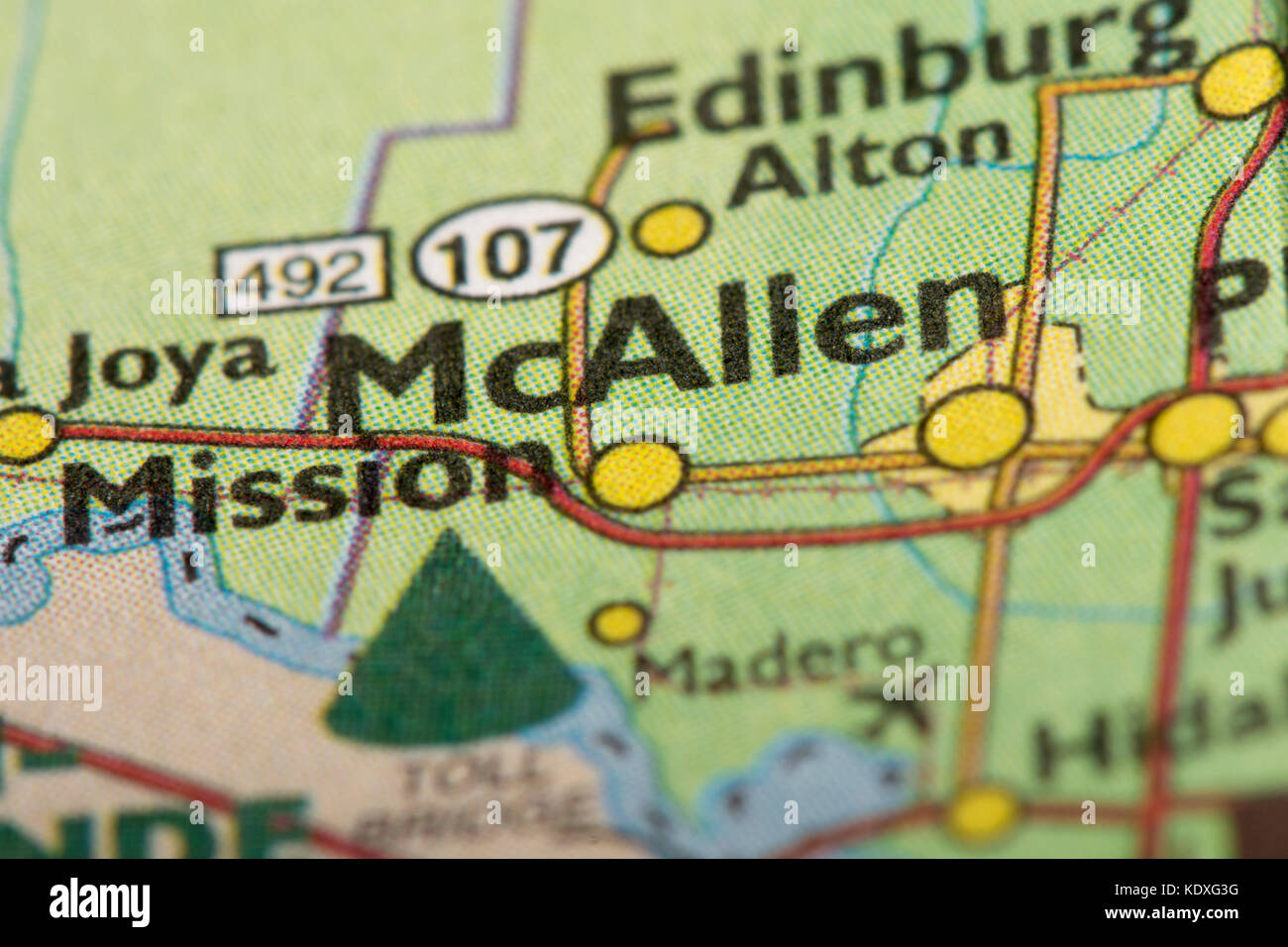

To decide if a property is approved to own a USDA mortgage, you could potentially make reference to this new USDA Eligibility Map. Believe it or not, 91 percent of your own You, and various parts of Florida, drops in USDA edge.

Because of this while an initial-day household customer looking to buy a house outside of metropolitan parts from inside the Florida, utilizing the USDA’s financial system would be a practical solution.

How does a USDA Financing Functions?

USDA financing into the Florida is actually line of because they’re protected of the the fresh U.S. Agencies from Farming, decreasing the risk to possess mortgage brokers and you will permitting them to provide lower rates of interest. Such financing have no prepayment penalties, making it possible for individuals to settle their loans very early versus more charge.

Considering the USDA verify, these types of fund normally have interest rates up to 0.50 percentage items less than other lowest-down-percentage options particularly HomeReady, HomePossible, and you will Antique 97, even lower than Virtual assistant mortgage loans, providing high benefit to own homeowners.

How does Brand new USDA Determine Outlying?

The definition of « rural » to have USDA loans for the Florida comes from Section 520 out of the fresh new Property Work of 1949.

Groups maybe not conference these rural conditions are classified as « urban. » It is very important remember that zero certain authorities meaning can be acquired for suburbs or exurbs. Therefore, all the You home fall under outlying otherwise metropolitan.

In the 2020, this new Census Agency delivered a lot more conditions to distinguish between outlying and you may cities during the amount of census tracts. An outlying census tract is defined as fulfilling another conditions:

- This is not contained in this an one half-kilometer radius regarding an airport that have an annual traveler count out-of 2,five-hundred or higher.

USDA Eligibility Map

You can make use of that it USDA eligibility chart to find an address and find out whether property currently fits the fresh new USDA’s loans in Eagle AK possessions qualifications requirements.

Utilising the USDA chart, you can rapidly see whether a home we need to get is entitled to the application form. Areas qualified to receive qualities can transform annual and therefore are determined of the population occurrence or any other issues.

A good USDA-recognized lender eg MakeFloridaYourHome is make sure new qualifications of all the features you prefer. To truly save your time with the services that may never be eligible, it is advisable to get in touch with a great USDA-recognized financial to verify the address for a beneficial USDA financing.

How do you Be eligible for good USDA Mortgage?

Potential home purchasers need to meet specific requirements of property venue and earnings in order to qualify for an effective USDA mortgage from inside the Fl. At exactly the same time, they want to see other important financial official certification.

Possessions Location

The home bought have to be into the an outlying census tract discussed by the USDA. The fresh new property’s qualification might be confirmed by using the USDA website otherwise asking their home loan company.

Money Eligibility

Home buyers should have children earnings within the USDA’s given low in order to moderate money constraints for their town. Such limits appear toward USDA site or is going to be obtained by way of a dialogue that have MakeFloridaYourHome.

Credit history

People are required to show a routine reputation for on-go out costs repayments, indicating their ability to handle financial responsibilities effortlessly.

Commentaires récents