You reside not simply a shelter but may additionally be the biggest monetary advantage, which have an esteem which can boost over time. Property collateral financing enables that borrow on brand new property’s well worth if you’d like to supply most currency. However, you can buy a consumer loan if you want a smaller matter otherwise want to borrow money to possess a smaller age date.

Family collateral financing

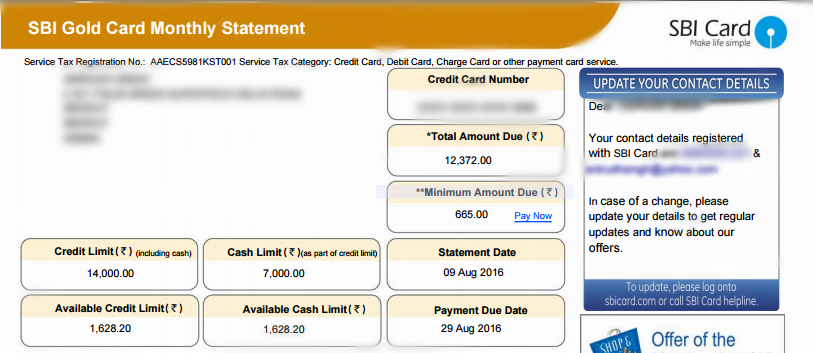

Guarantee are a good home’s latest worth without any amount you borrowed from in your financial. Home equity funds allow citizen to borrow funds up against its house’s equity. Family equity finance normally have lower interest levels and you will offered repayment terminology than just personal loans, but you need sufficient collateral to make use of since the guarantee whenever borrowing from the bank.

Loan providers keeps other regulations precisely how far it’s possible to borrow against the cornerstone out-of domestic collateral. However, extremely lenders provides a policy off retaining no less than 20% of the house really worth while the security and enabling you to borrow around 80% of the home worthy of without the remaiing home loan dominant – this is your available collateral.

A different home-manager might not yet , have sufficient collateral on to help you obtain currency which have property equity loan. The qualifications to have a home security mortgage relies upon just how fast you can pay off the loan and exactly how much the latest value of your house grows over the years.

Personal loan

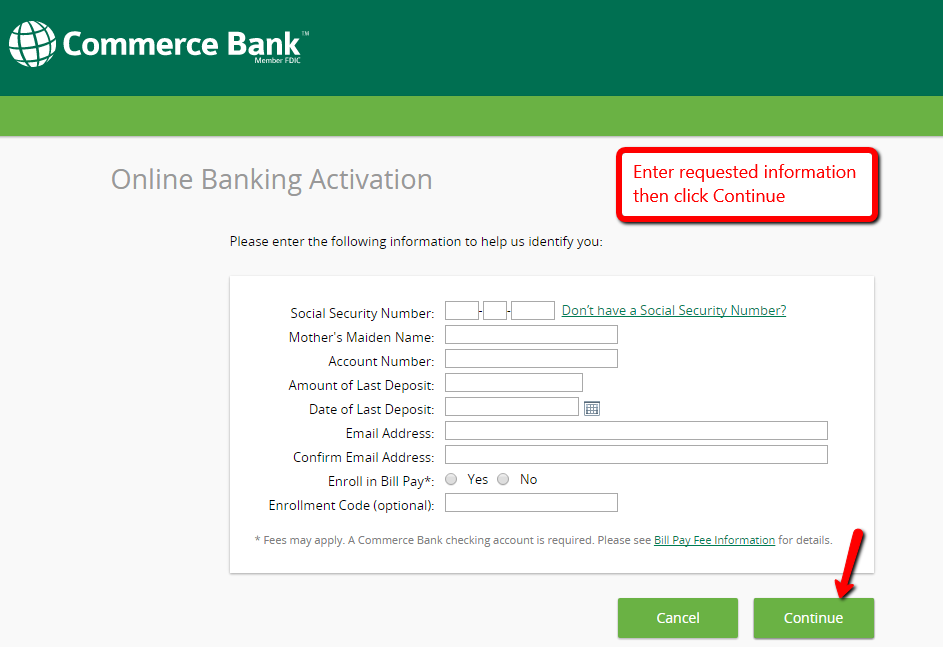

Individuals finance companies an internet-based loan providers give unsecured loans, in accordance with the borrower’s finances and you can creditworthiness. Consumers having excellent credit scores will end up being rapidly accepted private loans with lower rates. A borrower tends to be qualified to receive a loan of up to $a hundred,100000 if their credit history are strong and they have an effective apparently lowest debt so you can money proportion.

Unsecured loans are provided from the various banks, online loan providers, and you can borrowing from the bank unions. Signature loans are used for various more purposes, instance merging almost every other expense, traveling, buying a wedding or education.

House equity mortgage compared to personal bank loan – what type is the better look for?

Among rights away from homeownership is you can grow security regarding the assets every time you create a principal & attract homeloan payment. You might create wide range typically, so you can probably availableness later on compliment of property collateral loan.

You might sign up for a consumer loan of a financial otherwise most other lender in the event that you desire to. When you yourself have a good credit score, lower loans, and you will an excellent flow of cash, the financial institution ount you want.

Home collateral loans commonly bring straight down rates of interest compared to signature loans as bank uses the house since the security. However, it means discover a danger of losing your property for individuals who default in your payments subsequently.

The home guarantee loan application procedure can be a bit a great deal more time-drinking than is often the situation getting a personal bank loan. The method might take few weeks just like the lender will require to carry out a home valuation to verify your available guarantee number.

As to why prefer a property guarantee loan?

- You want to take a loan at lowest costs.

- You really have built up enough security, and would like to acquire more income.

- We need to consolidate a high rate of loans.

Whenever should you choose a personal bank loan?

- You want to obtain a smaller amount

- You want the mortgage for less time.

- You ought not risk set up your home since the defense because you will not want to help you chance shedding the home for folks who standard.

- You don’t be eligible for property security mortgage.

- You have an excellent credit history consequently they are qualified to receive the fresh lower personal loan pricing.

A home collateral loan can be a fantastic choice after you need a great deal to own household reount away from debt, purchasing some other possessions, etcetera. In addition, a consumer loan can be useful if you prefer currency to have a short span or a few thousand-dollar, having seemingly problem-100 % free processes.

If you don’t have home security available, you can imagine taking out fully a personal bank loan. One which just would, you may also make sure you has an excellent borrowing score and you can an excellent income so you can pay the new loan.

Commentaires récents